Ministerial foreword

Our country has faced-down and overcome some enormous challenges in recent years, all of which have shown the potential for us to genuinely go further and faster than anyone imagined in order to make people’s lives tangibly better. At the Department for Digital, Culture, Media & Sport, I am determined to ensure we continue to deliver at speed for the British people.

This is absolutely the case at Building Digital UK (BDUK). Over the past few months, multi-million pound local and regional Project Gigabit contracts have been awarded that will result in major improvements for people living in rural or otherwise hard-to-reach areas of the United Kingdom. Businesses will be boosted, job opportunities broadened, life chances enhanced.

It is vital work and I am proud to head the department that has taken such unprecedented strides in delivery. Because while it is easy to get lost in the numbers, you only have to visit a rural village or town to see what a difference we are making to individual lives. From phoning a loved one to starting a business, every home we connect counts.

Take Cumbria, and its £108 million deal agreed this month, which will level-up the county by helping deliver gigabit broadband to tens of thousands of homes and local businesses. This will be transformative not only for those residents, but for their communities too – bringing the best broadband to their homes and allowing local communities and businesses to thrive both economically and culturally.

The same applies to Teesdale and North Northumberland, two more areas which in the past couple of months have benefitted from the award of their own significant Project Gigabit contracts. Large swathes of England are now in procurement for Project Gigabit contracts valued at over £650 million, while in Wales, proactive engagement with the sector is beginning ahead of finalising procurement plans.

Project Gigabit is a huge government infrastructure programme; £5 billion of investment is bringing gigabit-capable coverage to 85% of the UK by 2025 and close to 100% as soon as possible thereafter. Few could have imagined that despite all the obstacles thrown in our way over the last few years, we would reach and exceed 70% coverage by this year, considering that we began at just 6% in 2019. It is a genuine British success story and one that shows what we are capable of when the government matches the nation’s ambitions with action and delivery.

Alongside our major contracts, the Gigabit Broadband Voucher Scheme allows eligible individuals and businesses to apply for vouchers to help incentivise broadband providers to build in certain areas. They are designed to target communities that might otherwise not be reached by planned commercial rollout or other Project Gigabit interventions.

The scheme and its previous iterations have already issued more than 111,000 vouchers. We are now enhancing the scheme still further – boosting the value of vouchers so individual applicants can access as much as £4,500 worth of support. It is a step-change in the programme and ensures targeted support for hard-to-reach areas, alongside the delivery of our local and regional contracts.

I was appointed as Secretary of State in September. In my time at DCMS, I have already seen that BDUK is an Executive Agency bursting with drive and talent. On the ground, we are making excellent progress with Project Gigabit, the largest digital infrastructure upgrade in decades that will boost our economy in the coming years. I am looking forward to the coming months, where I will be working hard to support BDUK as we deliver gigabit connections, generating growth and creating genuine opportunities for people across the UK.

Rt Hon Michelle Donelan MP

Secretary of State for Digital, Culture, Media and Sport

Summary

Across the UK, more than 72% of premises are now able to access gigabit-capable broadband, up from just 6% in early 2019 (ThinkBroadband, November 2022).

In recent months, BDUK has awarded Project Gigabit contracts which will improve broadband connections for tens of thousands of people in the North of England:

- Cumbria: £108 million for an estimated 59,000 premises

- North Northumberland: £7.3 million for an estimated 3,750 premises

- Teesdale: £6.6 million for an estimated 4,000 premises

In total four suppliers have now been awarded Project Gigabit contracts, with a combined value of more than £128 million. In the last quarter, BDUK launched regional procurements in Worcestershire and Buckinghamshire, part of Hertfordshire and East of Berkshire. We have now undertaken market engagement exercises across the whole of England.

Progress continues to be made across other areas and programmes for which BDUK has responsibility or oversight. Our Hubs projects with NHS Scotland have concluded, with 86 sites upgraded to have gigabit-capable broadband access, boosting practitioners’ connectivity and patients’ experiences. The most recent sites connected were in Skye and Argyll.

Additionally, BDUK has announced changes to the Gigabit Broadband Voucher Scheme. Especially noteworthy is trebling the value of vouchers for homeowners to £4,500 from £1,500, and for businesses to £4,500 from £3,500. These increased values, set to come into effect early in the New Year, will enable broadband suppliers to continue to connect premises in hard-to-reach locations.

BDUK became an Executive Agency in April of this year. Following the appointment of Simon Blagden CBE as Chair of BDUK in the summer, Fiona Driscoll and Stephen Unger have been appointed as BDUK non-executive directors and will take up their positions on 1 January 2023. They will join existing non-executive director Hazel Hobbs on the BDUK Board.

Progress towards a gigabit UK

This section outlines the level of gigabit-capable coverage across the devolved nations and regions, in urban and rural areas, by supplier and by residential and business premises. This information is based on two broadband coverage data sources:

- Independent website ThinkBroadband, which provides the most up-to-date information on national coverage, and is used to provide national and regional coverage statistics. This was sourced on 9 October 2022 and represents the latest coverage snapshot up to that date

- Ofcom data collected in May 2022 for its Connected Nations October 2022 report, which is the most up-to-date source of coverage broken down by residential and business premises, as well as rural and urban premises [footnote 1]

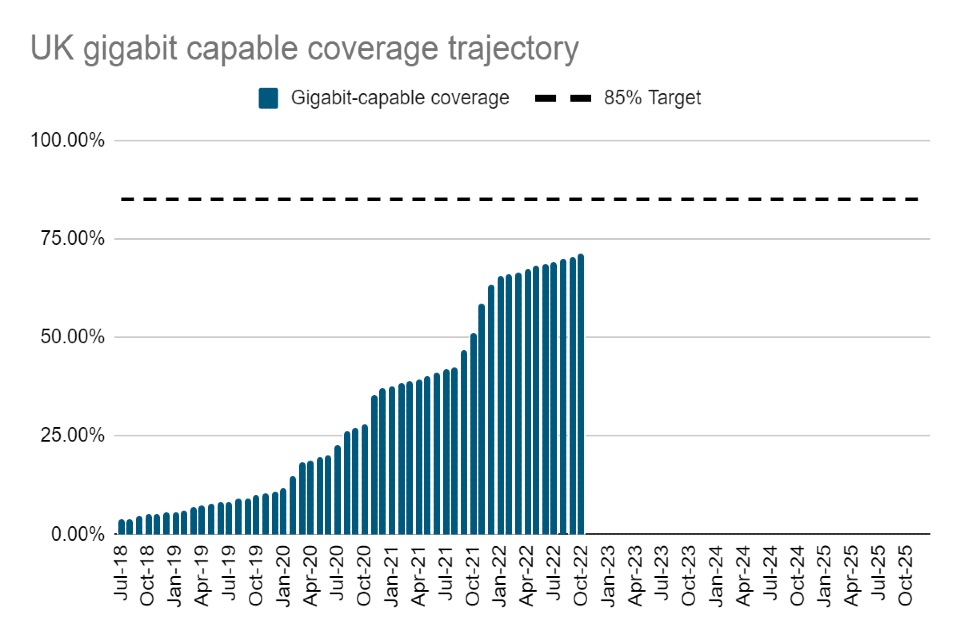

The graph below shows how gigabit coverage has increased since July 2018, and how this tracks against our forecast trajectory, combining BDUK and commercial delivery, towards our coverage target.

UK gigabit-capable coverage trajectory (Source: DCMS analysis, ThinkBroadband. Data is accurate as of 10 October 2022.)

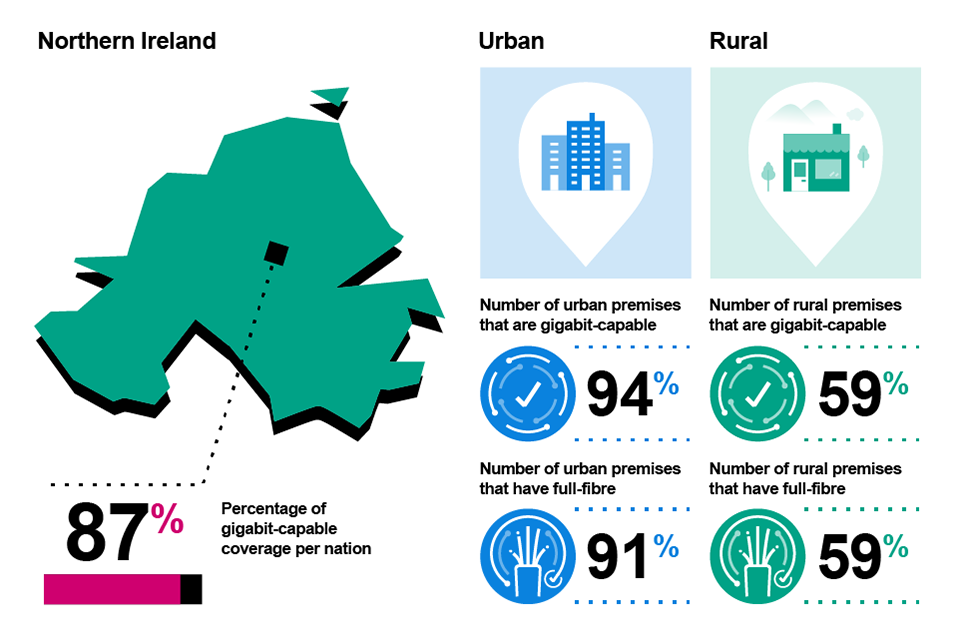

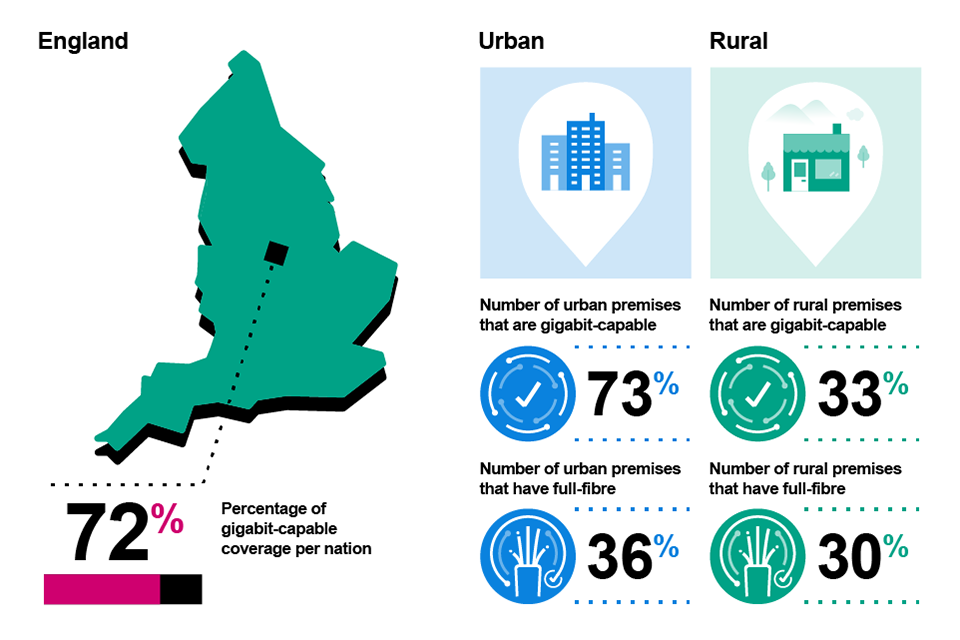

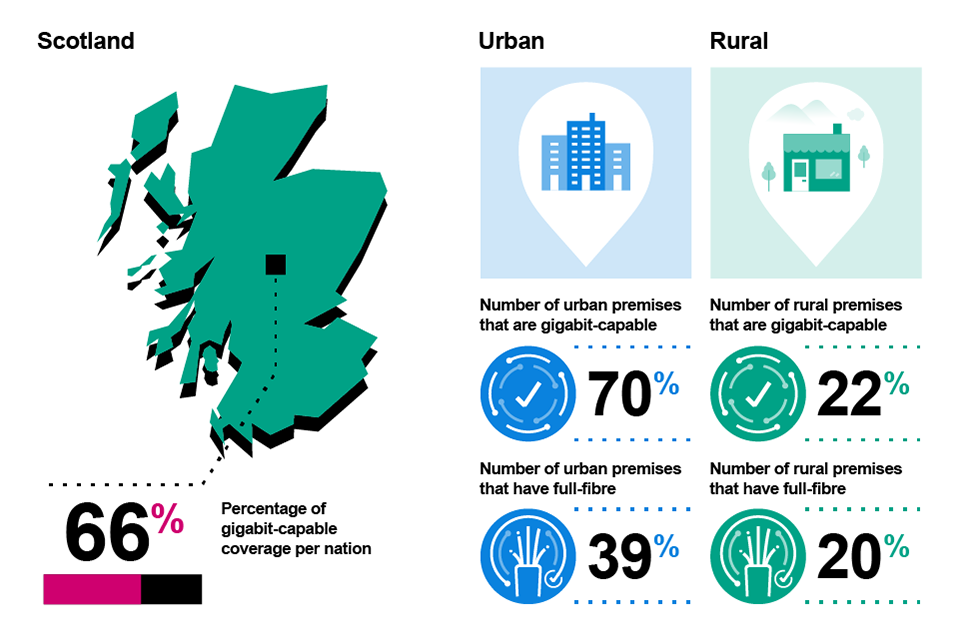

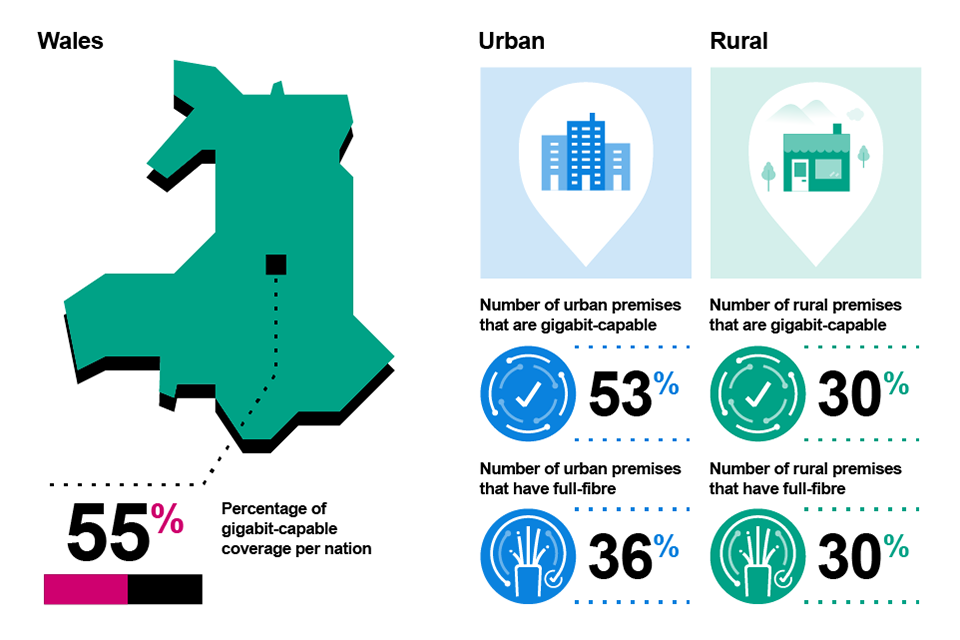

The graphics below show the coverage of gigabit-capable and full fibre broadband across the UK by nation, broken down by rural and urban premises.

Gigabit-capable coverage across the devolved nations (Source: ThinkBroadband, October 2022) and broken down by rurality and type of infrastructure (Source: Ofcom, Connected Nations Report, October 2022. Data accurate as of May 2022.)

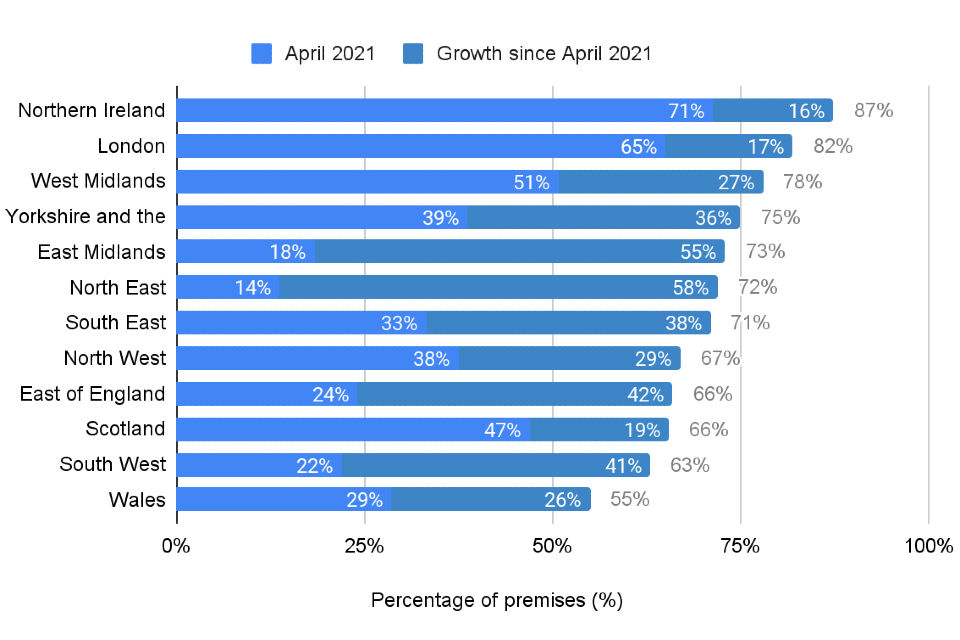

The graph below shows the growth in gigabit-capable broadband coverage across the devolved nations and the regions of England since the launch of Project Gigabit.

Growth of gigabit-capable coverage by region and devolved nation (Source: ThinkBroadband. Data accurate as of 10 October 2022)

In May 2022 (the latest date for which this information was collected by Ofcom), 43% of business premises had access to gigabit capability.

Gigabit-capable coverage by business premises – (Source: Ofcom, Connected Nations Report, October 2022. Data accurate as of May 2022)

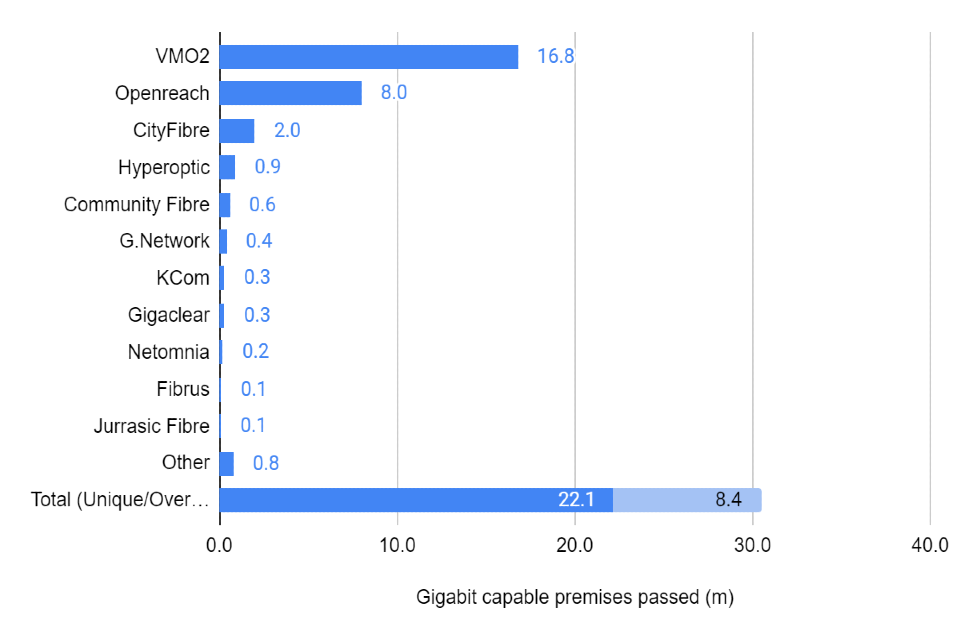

The graph below shows the number of premises passed with gigabit-capable broadband by supplier. Since we presented this data in the last update, CityFibre has added a further 300,000 premises. The data for this chart is reliant on reporting and public announcements by operators.

Premises passed (million) by a gigabit-capable network, broken down by supplier (Source: Operator Reports. Data is accurate as of 7 September 2022.)

Update on Project Gigabit delivery plans

Project Gigabit procurements

Following the award of our first local Project Gigabit contract in North Dorset in August, we have now awarded our first regional contract in Cumbria. With a value of £108 million, this is the largest contract under Project Gigabit to date, to roll out gigabit-capable broadband to up to 59,000 premises across the region.

We have also awarded further local contracts in Teesdale and North Northumberland, for £6.6 million and £7.3 million respectively. Borderlink Broadband will be rolling out gigabit-capable coverage to more than 4,000 premises in Teesdale and to just under 3,800 premises in North Northumberland.

A broad range of suppliers have engaged extensively and positively with our first set of procurements. Their responses give us an excellent understanding of how the market is developing and how our procurements can best deliver gigabit-capable coverage to a particular area.

Our interventions will always flex to respond to both changes in the dynamic marketplace, and the appetite for our procurements. We need to minimise the risk of subsidising projects to reach areas that are likely to be served commercially, and we may defer or revise our procurements in order to ensure we support the best way to deliver gigabit-capable coverage to an area.

In our regional procurement for the North East of England, responses to our National Rolling Open Market Review showed that there will be significantly more commercial delivery than was identified through the initial Public Review. We have used this more recent data to update the intervention area for the North East and we have relaunched the Invitation to Tender, in line with the process set out in the Open Market Review and Public Review guidance. This will ensure the best possible outcome for the area – maximising coverage and value for money – and we have revised our procurement timeline accordingly.

We have also extended the timelines for the regional procurement for Cambridgeshire and one of the local procurements in Cornwall. We continue to adopt the most efficient process to enable successful procurements that will deliver gigabit coverage within the programme’s timescale. The revised timetable for the Cornwall procurement aligns with the other local procurement in that region and we expect to award both contracts in January 2023.

In Lancashire and Surrey, our extensive engagement has shown that there is currently not sufficient interest from the market in responding to our proposed regional procurements. We are therefore deferring the launch of these regional procurements and looking at alternative options for providing coverage in these areas.

Since the last quarter we have launched regional procurements for Worcestershire and Buckinghamshire, East of Berkshire and parts of Hertfordshire, and will soon launch procurements for East and West Sussex, and Kent. We have deferred procurement for the remainder of Hertfordshire and for West Berkshire and we are continuing discussions with suppliers on potential interest for procurements in Oxfordshire.

We have now closed all Public Reviews for the whole of England. The final sets of suppliers’ commercial plans are being evaluated and assured for Herefordshire, Gloucestershire, Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding, Cheshire, Dorset, Devon and Somerset, Northern North Yorkshire, Essex, London, Merseyside and Greater Manchester, Newcastle and Tyneside, and Birmingham and the Black Country.

We are now running a regular four-monthly national Open Market Review. These exercises collect suppliers’ commercial plans, enabling us to understand those areas that will not be served by the market and may need subsidised intervention. The latest Open Market Review ran from 5 September to 17 October and 52 suppliers were invited to respond. The responses are currently being evaluated.

In Wales, the Public Review has been completed and market engagement is underway to determine the areas where we may intervene. Northern Ireland has launched its Open Market Review and, in Scotland, the Highlands and Islands Enterprise (HIE) has now closed a Public Review for a potential procurement in the Inverness area.

In August, we issued a Prior Information Notice (PIN) for a Cross-Regional Supplier framework and held a market engagement event in September. We are progressing with the development of the procurement and contract documentation and identifying areas where this framework may be needed. Subject to ongoing market engagement and governance, we expect to launch the procurement in January 2023.

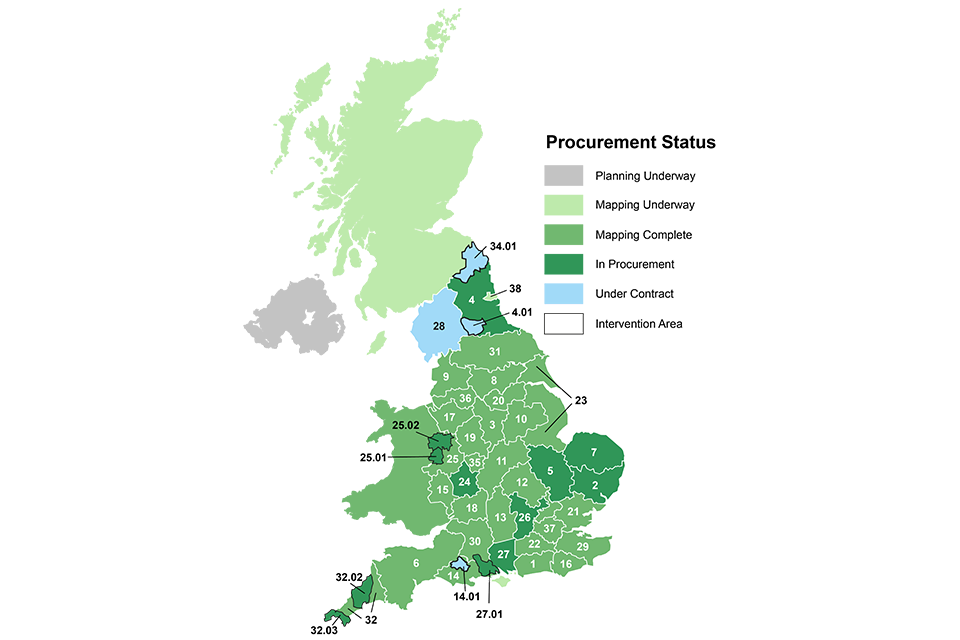

Project Gigabit Procurement Progress (Source: BDUK. Data is accurate as of November 2022.)

Our procurement strategy

As outlined in the winter update 2021, we work closely with suppliers when designing our procurement intervention areas, balancing the need for pace, coverage, value for money and the efficient use of BDUK resources with creating procurements that will attract sufficient market interest. Through this process, we have developed our procurement plans to respond to feedback from suppliers who are active in each region to form intervention areas that we hope will attract strong market interest.

We have taken forward both regional procurements aimed at larger suppliers and local procurements to suit rural specialists. We often consult the market about adjacent lots and in some cases we have responded to market feedback by merging lot areas into one larger procurement lot, or redrawing procurement boundaries to maximise interest.

In some areas, there has been limited opportunity for effective competition so we have not initiated either regional or local supplier procurement processes. Instead, we have deferred the area for further consideration to determine the most effective way to achieve gigabit capability.

In areas where we have no immediate procurement plans following consultation, we make vouchers available so that suppliers can once again propose and deliver voucher projects to the hard-to-reach communities.

Project Gigabit Intervention Areas map

See Annex for further details.

Gigabit vouchers

The Gigabit Broadband Voucher Scheme is an important part of Project Gigabit which has seen over 111,000 vouchers being issued through the scheme and its previous iterations. To date, more than 79,000 of these vouchers have been used to connect premises to gigabit-capable broadband.

As more areas across the country benefit from infrastructure built through our local and regional contracts, we are now relaunching the voucher scheme to ensure it complements this work and delivers targeted support to premises that are not included in those contracts. These premises are likely to be in particularly hard-to-reach areas and therefore we have made changes to the scheme to ensure it continues to stimulate build.

The changes include:

- Refining the eligibility criteria for projects – to better target premises in rural areas that we do not expect to be reached by suppliers’ commercial rollout plans or other Project Gigabit interventions

- Increasing the value of vouchers from £1,500 and £3,500 for homes and businesses respectively, to £4,500 for all beneficiaries – to enable suppliers to build to those hard-to-reach premises which are more expensive to access

- Launching a new platform – to allow suppliers to interact with the scheme more efficiently

- Strengthening supplier delivery reporting – to better monitor project build progress and encourage suppliers to deliver on their commitments

Project Gigabit in action: The Watercress Company

The Watercress Company, near Dorchester, Dorset, is a thriving international business supplying watercress, baby leaf salads and wasabi throughout the UK and Europe.

In 2021, the business received the boost of gigabit broadband, with the help of the Gigabit Broadband Voucher Scheme.

Previously, the company experienced slow internet speeds of only 0.5Mbps, limiting the business’s potential. Gigabit broadband has enabled the company to process more data more quickly, innovate and connect with customers, and it has improved efficiency and productivity.

The company has now diversified into growing and selling wasabi. This has only become possible thanks to the upgrade to lightning-fast broadband, which allows them to keep track of real-time data, monitor supplier needs and process large amounts of information to support their thriving ecommerce business.

Tom Amery, Managing Director of The Watercress Company, told BDUK: “Before gigabit, our business was a lot slower. The fundamental change really was to allow us to process information faster. Understanding how a company of our size needs to become more efficient is about data and that data crunching; the extra speed has given us much more of a pep to develop and progress in our industry.”

The business trades all products from their office in Waddock, Dorset, but maintains a permanent live ‘virtual office’ with staff based across England and in Jerez, Spain. This enables staff to interact immediately with one another, and is an essential access point for all farming staff. In particular, it helped to keep employees connected during the COVID-19 pandemic.

Public Sector Hub upgrades

We have continued to connect public sector buildings with fast, reliable broadband over the last quarter. We delivered gigabit-capable broadband to six public sector buildings in Dorset and connected further NHS Scotland sites in Inveraray and on the Isle of Skye.

The first series of procurements as part of our joint £82 million investment with the Department of Education to connect up to 3,000 schools in England to gigabit-capable broadband will launch early in the new year. By its conclusion the programme will have reached an estimated 500,000 primary school pupils.

Project Gigabit across the Union

Scotland

We have continued our work with NHS Scotland to connect health sites with gigabit broadband. To date, 86 sites have been connected including most recently Dunvegan Health Centre on the Isle of Skye and Inveraray Surgery in Argyll.

Following analysis of the Scotland-wide Open Market Review (OMR) which closed in March 2022, the Scottish Government has been engaging further with suppliers to understand the potential level of interest in new gigabit procurements in Scotland.

While we continue to work with the Scottish Government on the potential for Project Gigabit procurement activity, Highlands and Islands Enterprise, working in conjunction with both BDUK and the Scottish Government, launched a Public Review for a potential local procurement in the Inverness and Highland region as part of the Inverness and City Highland Region Deal. The Public Review process aims to validate the outcome of the Scotland-wide OMR and ensure the right areas are targeted for government investment. The consultation closed on 14 November 2022 and HIE will work to design a suitable intervention area based on supplier feedback, before progressing to procurement.

Gigabit vouchers continue to be actively delivered in Scotland. There have now been 2,700 voucher funded connections of which 200 benefited from the Scottish Government top-up.

In addition, the UK Government has invested over £49.5 million into the Scottish Government’s R100 programme which has now delivered over 12,000 gigabit-capable connections across Scotland.

Wales

The Public Review identified 231,400 premises across Wales that either do not have access to gigabit-capable broadband or are not in suppliers’ plans to provide such infrastructure over the next three years. This is only slightly different to our initial modelling which identified just over 234,000 premises. The Welsh Government is continuing its market engagement activity, with our support, to identify and refine potential Intervention Areas by January 2023.

Meanwhile, the Welsh Government’s Superfast Cymru programme continues to deliver gigabit-capable infrastructure in Wales. The original Superfast Cymru project completed in July 2019 and included access to gigabit-capable broadband to a portion of all the premises included in those contracts. The project will complete by the end of March 2023 and will provide up to a further 37,000 premises with access to gigabit-capable broadband. Approximately 32,500 premises have been reached to date.

The approval of gigabit voucher projects in Wales has been paused as the intervention area(s) for procurement is finalised, but active projects continue to deliver. As of the end of October 2022, we have connected 2,600 homes and businesses in hard-to-reach parts of Wales using vouchers. A further 2,900 vouchers had been issued for projects approved before the pause came into effect.

Northern Ireland

Northern Ireland continues to lead gigabit connectivity across the UK with gigabit-capable coverage exceeding 86%. Of the 85,000 premises covered by Project Stratum, over 45,000 have been delivered to date.

Project Gigabit in Northern Ireland will launch an Open Market Review (OMR) on 8 December 2022. The OMR will run for 7 weeks and conclude on 26 January 2023.

Project Gigabit in action: Theatr Colwyn’s transformation

Theatr Colwyn, built in 1888 and the oldest civic theatre/cinema in Wales, had its internet speeds increased by 700% in May 2021 as a consequence of a neighbourhood Local Full Fibre Network project.

The majority of Theatr Colwyn’s feature films now arrive via a server over broadband, and download time has decreased dramatically. This in turn has reduced Theatr Colwyn’s carbon footprint as it no longer has to rely on courier services to deliver 35mm film reels to their location on the Welsh coast.

Films can be ordered, downloaded and played to an audience of 200 local people within 24 hours. The films are also of greater visual quality – including up to 4K resolution – as these are sent overnight via broadband to the theatre’s server.

Theatr Colwyn is also able to livestream certain events, such as meetings and gallery showcases. During the pandemic, it showcased a recorded performance of a pantomime to audiences in their homes.

All staff can work on the laptops at greater speed, and the internet-based box office system benefits from having the improved connectivity to make bookings and payments as quickly as possible.

“Gigabit-capable broadband has changed things enormously,” says manager Phil Batty. “Customers can now be served literally within 20 seconds from start to finish.”

“There are so many advantages to having the new broadband.”

Relevant policy, legislative and regulatory updates

Very Hard To Reach premises

Very Hard to Reach premises are premises which are unlikely to be able to access a gigabit-capable broadband service via either Project Gigabit funding or commercial rollout due to their rurality and the potential cost and complexity of delivering such a service.

DCMS continues to engage with stakeholders to develop policy for Very Hard to Reach premises, based on the responses to our previous call for evidence.

We have now announced the launch of Alpha trials in a number of locations to test the viability of satellite connectivity with multiple stakeholders to a limited number of remote premises across the UK that are believed to be Very Hard to Reach.

The first four of these initiatives that can be disclosed at this stage are:

- An alpha trial working in conjunction with English Heritage at Rievaulx Abbey, in North Yorkshire National Park

- A feasibility study in Wasdale Valley, Lake District National Park

- Separate alpha trials in Ogwen Valley and Crafnant Valley respectively, both in Snowdonia National Park

Connectivity to the first tranche of alpha trial sites will be delivered by DCMS using Starlink’s Low Earth Orbit satellite constellation. We will provide further information on additional sites, suppliers and the delivery mechanisms used to connect them, in the coming months.

New build connectivity

New regulations coming into force on 26 December 2022 will require the installation of gigabit-ready infrastructure and gigabit-capable connections during the construction of new homes. The regulations were laid in Parliament on 26 September 2022 following the publication of a technical consultation response on 22 September.

Update on commercial investment in UK gigabit infrastructure

Since the launch of Project Gigabit, capital has continued to flow into the digital infrastructure marketplace. Over the last quarter, suppliers have announced further investment including: Community Fibre (£985 million), Brsk (£178 million), SpringFibre (£125 million) Rural Broadband Solutions (£75 million), F&W (£25 million), and Wessex Internet (Unknown).

The following suppliers have announced their latest overall progress deploying gigabit-capable broadband to premises across the UK: Openreach (8.7 million), Trooli (275,000), Netomnia (265,000), F&W Networks (185,000), Truespeed (50,000), Zzzoomm (50,000), 4th Utility (40,000), WightFibre (40,000), FibreNest (25,000)

More than 30 suppliers have also announced or finalised new gigabit-capable broadband deployment plans including Axione, Beacons Telecom, BeFibre, Brsk, CityFibre, Community Fibre, Connect, Connexin, County Broadband, Fibrus, Freedom, Full Fibre UK, Gigaloch, Giganet, GoFibre, Grain, ITS, Lightning, LilaConnect, Lit, Lothian, MS3, Netomnia, Newark, Openreach, Quickline, Spring Fibre, Swish, Toob, Truespeed, Virgin Media, Voneus, Vorboss, Wildanet, and Zzoomm.

Annex

Project Gigabit procurement pipeline

Live contracts:

| Local or regional supplier procurement | Area and Lot number | Contract signature date | Estimated number of premises in scope of the contract (subject to change) | Contract value |

|---|---|---|---|---|

| Local | North Dorset (Lot 14.01) | 25 August 2022 | 7,100 | £6.3 million |

| Local | Teesdale (Lot 4.01) | 22 September 2022 | 4,100 | £6.6 million |

| Local | North Northumberland (Lot 34.01) | 14 October 2022 | 3,790 | £7.3 million |

| Local | Cumbria (Lot 28 | 29 November 2022 | 59,000 | £108.5 million |

Live and upcoming procurements:

The tables below show the live procurements and upcoming procurements posted on the GOV.UK website. Our planned timetable is subject to market feedback and suppliers being willing and able to respond. In some cases more time will be required to run the end to end process.

The pipeline represents an indicative forward view of commercial activity to be undertaken by the programme. Some of the information provided is based on modelled data that will be superseded. The low and high contract values represent a possible range of funding; actual contract values are likely to be spread across the range for each lot. This pipeline is subject to change based on emerging data and feedback, following open market reviews, public reviews and market engagement.

Live procurements:

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Number of premises in scope of the procurement (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Local | Central Cornwall (Lot 32.03) | 17 March 2022 | January 2023 | 9,750 | £18 million |

| Local | South West Cornwall (Lot 32.02) | 28 April 2022 | January 2023 | 9,500 | £18 million |

| Local | New Forest (Lot 27.01) | 7 July 2022 | April to June 2023 | 10,500 | £14.5 million |

| Local | Mid West Shropshire (Lot 25.01) | 15 July 2022 | April to June 2023 | 7,300 | £10.8 million |

| Local | North Shropshire (Lot 25.02) | 15 July 2022 | April to June 2023 | 12,200 | £24 million |

| Regional | North East England (Lot 4) | 18 January 2022 | April to May 2023 | 53,250 | £82.7 million |

| Regional | Cambridgeshire and adjacent areas (Lot 5) | 7 January 2022 | February 2023 | 49,700 | £68.6 million |

| Regional | Norfolk (Lot 7) | 28 April 2022 | March 2023 | 86,200 | £114.2 million |

| Regional | Suffolk (Lot 2) | 28 April 2022 | March 2023 | 87,200 | £100.4 million |

| Regional | Hampshire (Lot 27 | 25 July 2022 | April to June 2023 | 88,600 | £104.1 million |

| Regional | Worcestershire (Lot 24) | 6 October 2022 | July to September 2023 | 18,460 | £39.4 million |

| Regional | Buckinghamshire, (part of) Hertfordshire and East of Berkshire (Lot 26) | November 2022 | July to September 2023 | 40, 320 | £58.7 million |

Upcoming procurements

| Local or regional procurement | Area and Lot number | Procurement start date | Estimated contract award date (subject to change) | Estimated number of premises outside supplier plans (subject to change) | Indicative contract value (£ million) (subject to change) |

|---|---|---|---|---|---|

| Regional | Kent (Lot 29) | December 2022 | July to September 2023 | 72,000 | £112 million |

| Regional | East and West Sussex (Lots 16 and 1) | January 2023 | July to September 2023 | 62,100 | £100 million |

| Regional | Bedfordshire, Northamptonshire and Milton Keynes (Lot 12) | December 2022 to February 2023 | October to December 2023 | 46,700 | £60 million |

| Regional | Derbyshire (Lot 3) | December 2022 to February 2023 | October to December 2023 | 36,210 | £53 million |

| Regional | Wiltshire and South Gloucestershire (Lot 30) | December 2022 to February 2023 | October to December 2023 | 84,800 | £85 to 145 million |

| Regional | Leicestershire and Warwickshire (Lot 11) | February to April 2023 | November 2023 to January 2024 | 72,200 | £90 million |

| Regional | Nottinghamshire and West of Lincolnshire (Lot 10) | February to April 2023 | November 2023 to January 2024 | 46,900 | £63 million |

| Regional | West Yorkshire and parts of North Yorkshire (Lot 8) | February to April 2023 | November 2023 to January 2024 | 45,990 | £68 million |

| Regional | South Yorkshire (Lot 20) | February to April 2023 | November 2023 to January 2024 | 51,780 | £55 million |

| Procurement type TBC | Lancashire (Lot 9) | TBC | TBC | 31,000 | £55 million |

| Procurement type TBC | Surrey (Lot 22)* | TBC | TBC | 99,400 | £101 to 171 million |

| Procurement type TBC | Shropshire (Lot 25)* | TBC | TBC | 20,700 | £30 to 40 million |

| Procurement type TBC | Staffordshire (Lot 19)* | TBC | TBC | 70, 800 | £72 to 123 million |

| Procurement type TBC | Oxfordshire and West Berkshire (Lot 13)* | TBC | TBC | 18,500 | £32 million |

| Regional | Cheshire (Lot 17) | April to June 2023 | January to March 2024 | 74,300 | £85 to 144 million |

| Regional | Devon and Somerset (Lot 6) | April 2023 | January to March 2024 | 159, 600 | £198 to 337 million |

| Regional | Herefordshire (Lot 15) | April to June 2023 | January to March 2024 | 23,700 | £30 to 60 million |

| Regional | Gloucestershire (Lot 18) | April to June 2023 | January to March 2024 | 44,700 | £40 to 80 million |

| Regional | Lincolnshire (including NE Lincolnshire and N Lincolnshire) and East Riding (Lot 23) | April to June 2023 | January to March 2024 | 105, 700 | £106 to 180 million |

| Regional | Dorset (Lot 14) | July to September 2023 | April to June 2024 | 56,500 | £62 to 105 million |

| Regional | Essex (Lot 21) | July to September 2023 | April to June 2024 | 78, 400 | £79 to 135 million |

| Regional | Northern North Yorkshire (Lot 31) | July to September 2023 | April to June 2024 | 28,200 | £25 to 42 million |

| Regional | Birmingham and the Black Country (Lot 35) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Merseyside and Greater Manchester (Lot 36) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Greater London (Lot 37) | July to September 2023 | April to June 2024 | TBC | TBC |

| Regional | Newcastle and North Tyneside (Lot 38) | July to September 2023 | April to June 2024 | TBC | TBC |

*Following significant soft market testing and pre-procurement market engagement with suppliers we have established that there is currently no interest from the market in responding to our proposed regional procurements in these areas. We are therefore deferring the launch of the regional procurements in these areas and reviewing other options to provide coverage in these areas at a later date.

If you are a supplier who wishes to view or register interest for any of the opportunities under Project Gigabit, all details can be found on BDUK’s e-sourcing system, Atamis. The procurement documents are available for unrestricted and full direct access, free of charge.

Additional information can be obtained from the above-mentioned address.

Tenders or requests to participate must be submitted to the above-mentioned address.

Gigabit vouchers issued or claimed

| Fiscal year | Total vouchers issued | of which yet to be connected | of which used to fund a connection |

|---|---|---|---|

| 2017 to 2018 | 40 | 0 | 40 |

| 2018 to 2019 | 6,900 | 0 | 6,900 |

| 2019 to 2020 | 15,900 | 0 | 15,900 |

| 2020 to 2021 | 19,600 | 1,200 | 18,400 |

| 2021 to 2022 ( r ) | 36,800 | 13,900 | 22,900 |

| 2022 to 2023 ( p )* | 31, 900 | 17,100 | 14, 900 |

| Total | 111,200 | 32,000 | 79,000 |

*as of 2 November 2022

Source: BDUK as of November 2022

( p ) – provisional

( r ) – revised

Notes:

1. Figures rounded to the nearest 100, except for 2017 to 2018.

2. Removal of 2 vouchers from 2021 to 2022 figures due to voucher status change.

Vouchers used to fund a connection

| Fiscal year | England | Northern Ireland | Scotland | Wales | Total |

|---|---|---|---|---|---|

| 2017 to 2018 | 40 | 0 | 0 | 0 | 40 |

| 2018 to 2019 | 6,200 | 400 | 200 | 100 | 6,900 |

| 2019 to 2020 | 13,800 | 1,100 | 600 | 400 | 15,900 |

| 2020 to 2021 | 14,100 | 2,800 | 800 | 600 | 18,400 |

| 2021 to 2022 ( r ) | 19,500 | 1,700 | 600 | 1,100 | 22,900 |

| 2022 to 2023 ( p )* | 12,700 | 1,200 | 500 | 500 | 14,900 |

| Total | 66,300 | 7,300 | 2,800 | 2,600 | 79,000 |

*as of 2 November 2022

Source: BDUK as of November 2022

( p ) – provisional

( r ) – revised

Notes:

1. Figures rounded to the nearest 100, except for 2017 to 2018.

2. Removal of 2 vouchers from 2021 to 2022 figures due to voucher status change.

Public Sector Hubs

| Fiscal year | Rural Gigabit Connectivity | LFFN ( p ) | GigaHubs | Total |

| 2017 to 2018 | 0 | 0 | 0 | 0 |

| 2018 to 2019 | 0 | 0 | 0 | 0 |

| 2019 to 2020 | 20 | 0 | 0 | 20 |

| 2020 to 2021 | 220 | 1,700 | 0 | 1,920 |

| 2021 to 2022 ( r ) | 780 | 3,900 | 10 | 4,690 |

| 2022 to 2023 ( p ) | 0 | 0 | 10 | 10 |

| Total | 1,020 | 5,600 | 10 | 6,630 |

*as of 2 November 2022

Source: BDUK as of November 2022

( p ) – provisional

( r ) – revised

Notes:

1. Figures rounded to the nearest 10.

2. Revision to RGC total from 1,021 to 1,020 – this is correcting an arithmetic error.

3. LFFN includes both hubs and assets. Figure differs from that within the performance report as only. hubs count towards BDUK’s 5% target.

4. GigaHubs delivered are counted when status moves to “build – not live”.